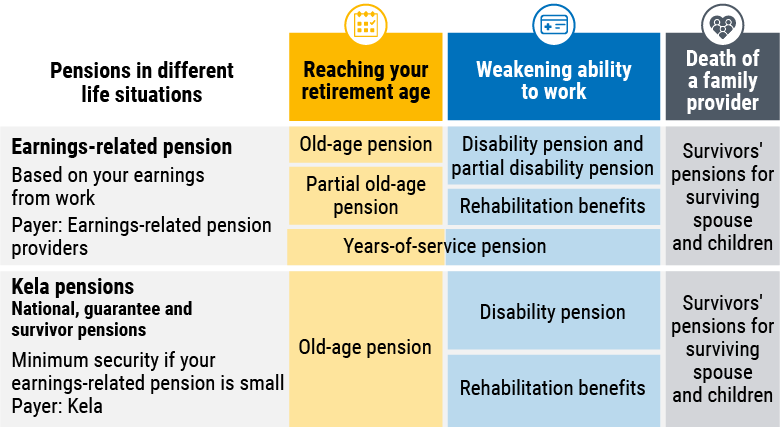

Earnings-related pensions help you in different life situations. In this section you can read about the different pension benefits.

The most common earnings-related pension is the old-age pension. But earnings-related pensions provide for you also if you become disabled or if a wage earner in your family dies. You can retire on a partial old-age pension when you turn 61 or 62, depending on your year of your birth.

Most pensions are earnings-related pensions. You earn your earnings-related pension by working or by being a self-employed person. Earnings-related pensions are paid by pension providers. If your earnings-related pension is small, you may have a right to receive a national or a guarantee pension paid by Kela.

Earnings-related pension benefits based on your work are paid out one at a time

Earnings-related pension benefits that are based on your work (for example, the old-age pension, the partial old-age pension, the disability pension and the years-of-service pension) are paid out one at a time. In other words, they are mutually exclusive. That is why you cannot receive a partial old-age pension and a (partial) disability pension at the same time.

The survivor’s pension is an exception – you can draw it at the same time as you draw other earnings-related pension benefits. That is why you can get an old-age pension and a survivors’ pension at the same time.

Pension benefits in brief

Old-age pension

An earnings-related pension provides you with a secure income after your working life. You can retire at the earliest when you reach the statutory retirement age for your age group. Your year of birth therefore determines when you can retire. The older you are when you retire, the higher your pension will be.

Partial old-age pension

When you are on a partial old-age pension, you can decide yourself how much you want to work. To qualify for a partial old-age pension, you must have been born in or before 1963 and be at least 61 years old. The minimum age rises to 62 for those born in 1964 . The part of your pension that you take out early (before you reach your retirement) age will be permanently reduced.

Rehabilitation or disability pension

Rehabilitation is always a primary alternative if your work ability is reduced. Rehabilitation can help you continue working.

The disability pension is an option only once your illness, handicap or injury reduce your working ability in the long run, for more than one year.

Years-of-service pension

You may qualify for a years-of-service pension if:

- you have done mental or physical work that requires great effort for at least 38 years;

- your ability to work is reduced;

- you were born in 1955 or later; and

- you are 63 years old.

Survivors’ pensions

The survivors’ pensions replace income that is lost when a family wage earner dies.