As a rule, when you work abroad as an employee, you are covered by the social security of the country in which you work. However, under certain conditions, you can be covered by Finnish social security although you work abroad.

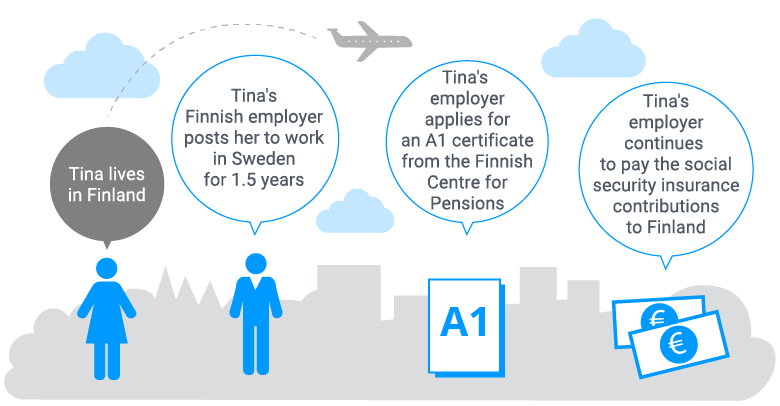

If you are posted abroad to work for a Finnish employer, you will be insured in Finland. You can be posted abroad temporarily to an EU/EEA country, Switzerland or a country with which Finland has signed a social security agreement. In that case, you will continue to be covered by Finnish earnings-related pension acts and social security.

You are a posted employee if:

- you are working abroad for a Finnish employer,

- you are covered by Finnish social security when you go abroad to work,

- you work abroad temporarily (for a maximum of 2 years or 3-5 years (social security agreement countries).

If you are a posted employee, you need an A1 certificate. It proves that you are covered by Finnish social security while you work abroad. As a rule, your employer will apply for the certificate. When you have the certificate, you and your employer do not have to pay social insurance contributions to the country in which you work. That means that all your social security contributions are paid to Finland only.

If you are posted for more than two years, you need an exemption. If you are a posted employee, your employer will apply for the exemption using the same form as when applying for the A1 certificate. If you are self-employed, you have to apply for the exemption yourself.

Posted to a non-agreement country

If your Finnish employer posts you to work in a country with which Finland does not have a social security agreement (for example, Brazil), your employer must insure your work under Finnish earnings-related laws throughout the period of posting, regardless of for how long you are posted. Since there is no social security agreement with the country in which you work, you may have to be insured in that country, as well.

When you work in a non-agreement country, the Finnish Centre for Pensions will not give you an A1 certificate. Instead, you have to contact Kela, which will issue a decision on your right to residence-based social security when needed.

Pension based on pensionable earnings

When you work abroad, your pension funds will grow based on your pensionable earnings. The pensionable earnings is the wage that you would receive in Finland for the work that you do abroad or the wage that would correspond to the work you do. That means that your pension and your pension contributions for the work that you do abroad are not determined on the earnings you actually receive when you work abroad.

The rule on the pensionable earnings is applied to all work you do abroad as a posted employee that is insured in Finland under the Employees Pensions Act (TyEL).

For more information on insurance, contact the Finnish Centre for Pensions:

- phone: +358 29 411 2110,

- e-mail: ulkomaanasiat(at)etk.fi.